Coats Column: A New Proposal to Address Our Looming Debt Crisis

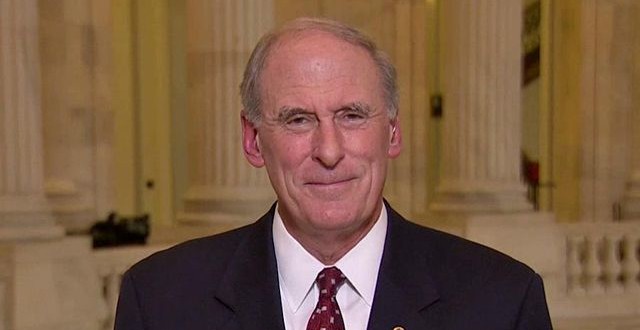

Senator Dan Coats

The warning signs are right before our eyes. Out-of-control federal spending is threatening to bankrupt the health and retirement security programs depended on by seniors in Indiana and millions of Americans across the country.

The non-partisan Congressional Budget Office projects that Medicare Part A will be bankrupt in 2026 and the Social Security Trust Funds will be exhausted by 2030 if Congress takes no action. As a result, Social Security beneficiaries will face an automatic cut of 29 percent in benefits.

Given this reality, inaction is not a viable solution. If policymakers fail to make necessary reforms today, more drastic and painful changes will be forced upon us down the road.

The good news is there is still time to do the right thing. I believe smart reforms to federal spending can be made that preserve benefits for current enrollees and those approaching retirement age.

I recently introduced a new proposal to address our fiscal challenges and make structural changes to the way your taxpayer dollars are spent. My bill, the Mandatory Bureaucratic Realignment and Consolidation Commission Act, is based on a model that the Defense Department has used successfully for years.

The defense Base Realignment and Closure (BRAC) is an existing process in which an independent commission makes recommendations to improve Department of Defense efficiency, and Congress then considers these recommendations as a whole. This process has worked well for the military, and I believe it should be applied across the federal government.

Using the defense BRAC model, my legislation would create a civilian commission to streamline federal mandatory spending programs, which are the primary drivers of all federal spending. These are federal programs that run on auto-pilot and are not subject to congressional oversight. The commission created by my bill would be comprised of private-sector experts equally appointed by leaders of both political parties. These private citizens, who would not be worried about their political careers, would develop a proposal to balance the federal budget and improve the structure of mandatory programs.

The commission would be asked to review the goals and effectiveness of every mandatory spending program and look for ways to increase efficiencies. It would have a number of options for examining mandatory spending programs, including:

- Reforming how a mandatory program operates,

- Consolidating mandatory programs that share the same goals,

- Eliminating mandatory programs that have not proven effective,

- Identifying ways to increase efficiency and reduce spending on mandatory programs by shifting responsibility to states or private entities; and,

- Shifting programs from mandatory to discretionary spending.

The commission would then put this plan before Congress for an up or down vote through an expedited process. The process would force members of Congress to take a stand on our debt crisis.

If Congress fails to adopt the commission’s suggestions or to take other action to achieve savings, my bill would trigger a growth cap to limit government spending. Specifically, it would limit the growth of total, non-interest spending to three percent annually. This would not be a spending cut, but simply a way to prevent the federal government from increasing spending by more than three percent each year, until the budget returns to balance.

Congress continues to kick the can down the road on mandatory spending. Now is the time to take steps toward financial stability and force Congress to take action.

Sen. Dan Coats is a Republican from Indiana.