Coats Column: America Needs Tax Reform

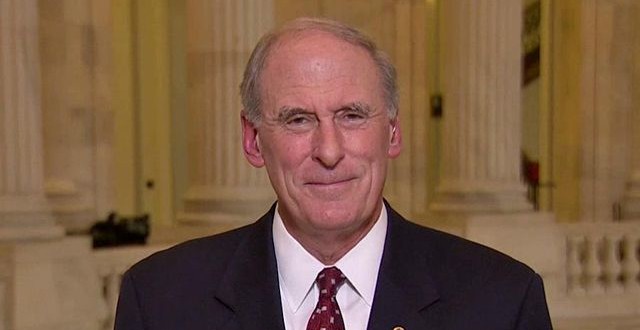

Senator Dan Coats

Americans got a three day reprieve when this year’s deadline for filing taxes was moved to April 18. But taxpayers received no reprieve from dealing with a burdensome, outdated tax system.

The U.S. tax code is a tangled web of exemptions, deductions, credits and other special-interest preferences that costs Hoosier families and businesses valuable time and resources. Rather than benefiting our economy, the current tax system is an anchor dragging down economic growth and stifling job creation.

Case in point: The Internal Revenue Service estimates that Americans across the country spend more than six billion hours each year preparing and filing their taxes. Recent estimates of what it costs taxpayers to comply with our tax system range as high $987 billion annually. Sheer complexity forces 90 percent of taxpayers to either turn to a paid preparer or buy software to figure out their tax burden.

History shows that a simpler, flatter and fairer tax system will help make our country more competitive, create jobs and reduce our national debt. Thirty years ago, President Ronald Reagan teamed up with lawmakers from both parties to pass the Tax Reform Act of 1986, which lowered and simplified tax rates and eliminated special-interest loopholes.

When he signed the bill into law, President Reagan said, “Fair and simpler for most Americans, this is a tax code designed to take us into a future of technological invention and economic achievement, one that will keep America competitive and growing into the 21st century.” In the two years that followed, new jobs were created. America also enjoyed strong economic growth of 4.4 percent during the Reagan recovery.

But times and the tax system have changed since then. Congress has managed to complicate Reagan’s simplified tax system by turning two tax rates into seven and adding thousands of loopholes, deductions and credits that benefit only a few. America is stuck with an anemic economic growth rate of just two percent during the current recovery, less than half of the rate of growth seen under President Reagan.

Reforming our tax code will help businesses, both large and small. Since 1986, our corporate tax rate changed from being one of the most competitive to the highest in the developed world. In addition, the top tax rate faced by small businesses rose from 28 percent to 44.6 percent, including Obamacare taxes and other penalties, and entrepreneurs have been crushed by complexity.

Tax reform also will help Hoosier families. Simplifying the tax code could make it possible for most Hoosiers to complete their taxes in less than one hour and on one page, and families would reap the benefits of a growing economy.

The National Association of Manufacturers released a study showing the costs of delaying pro-growth reform over a decade: an economy that is $12 trillion smaller, lower wages, 6.5 million fewer workers with jobs and over $3.3 trillion less investment in the United States.

When more Americans are working, more people are paying taxes, and when more taxes are being paid, more debt can be wiped off our books. Simplifying and reforming the tax system is a proven way to jumpstart the economy and reduce debt.

We cannot afford to wait much longer.

Sen. Dan Coats is a Republican from Indiana.