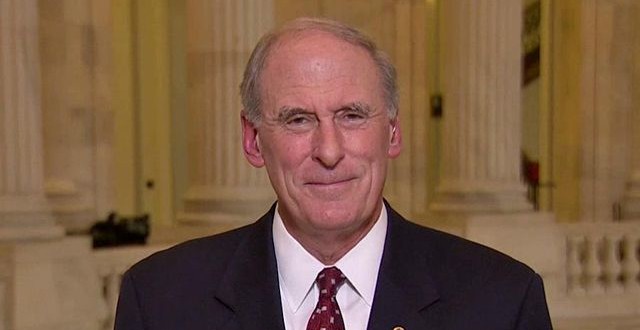

WASHINGTON, DC – Senator Dan Coats (R-Ind.) joined with 32 senators to introduce a resolution to stop the Obama Administration from implementing a harmful new regulation that will have devastating effects on retirement planning by hard-working families and small businesses.

On April 6, 2016, the U.S. Department of Labor finalized a rewrite of its definition of a “fiduciary,” allegedly to protect individuals from misleading investment advice. In practice, however, the new rule will make retirement planning unaffordable for low- to middle-income Americans whose accounts are not valuable enough for advisors to take on the new legal liability created by the rule. A similar rule adopted in the United Kingdom led to many small investors losing access to financial advice.

The senators filed a resolution of disapproval under the Congressional Review Act to reject the administration’s so-called “Retirement Advice Gag Rule.”

If approved, the resolution of disapproval would allow Congress to stop the Department of Labor from implementing this harmful rule.

Under the Congressional Review Act, the House and Senate vote on a joint resolution of disapproval to stop, with the full force of law, a federal agency from implementing a rule or regulation or issuing a substantially similar regulation without congressional authorization. A resolution of disapproval only needs a simple majority to pass and cannot be filibustered or amended, if acted upon during a 60-day window. The resolution of disapproval must also be signed by the president or Congress can overturn a veto with a two-thirds vote in both the Senate and the House.

Senator Johnny Isakson (R-Ga.) is the lead sponsor of the resolution of disapproval, which is co-sponsored by Coats and Senators Lamar Alexander (R-Tenn.), Mike Enzi (R-Wyo.) Kelly Ayotte (R-N.H.), John Barrasso (R-Wyo.), Roy Blunt (R-Mo.), John Boozman (R-Ark.), Shelley Moore Capito (R-W.Va.), Bill Cassidy (R-La.), Thad Cochran (R-Miss.), Mike Crapo (R-Idaho), Steve Daines (R-Mont.), Joni Ernst (R-Iowa), Deb Fischer (R-Neb.), Orrin Hatch (R-Utah), James Inhofe (R-Okla.), Ron Johnson (R-Wis.), Mark Kirk (R-Ill.), James Lankford (R-Okla.), Mike Lee (R-Utah), Mitch McConnell (R-Ky.), Jerry Moran (R-Kan.), Lisa Murkowski (R-Alaska), Rand Paul (R-Ky.), David Perdue (R-Ga.), Pat Roberts (R-Kan.), Marco Rubio (R-Fla.), John Thune (R-S.D.), Thom Tillis (R-N.C.), David Vitter (R-La.), Tim Scott (R-S.C.) and Roger Wicker (R-Miss).

Background:

In October 2010, the Department of Labor proposed rewriting its regulatory definition of a “fiduciary,” allegedly to protect individuals from misleading investment advice. However, the administration later withdrew its rule amid widespread, bipartisan criticism that the proposal would essentially prevent lower- and middle-income investors from gaining access to the advice market and would likely result in confusion and ultimately discourage savings participation.

Despite these concerns, the Department of Labor finalized its fiduciary rule in April 2016 that fails to address many of the issues contained in the previous rule.

The rule was made final on April 6, 2016

WYRZ.org 98.9 WYRZ – The Voice of Hendricks County

WYRZ.org 98.9 WYRZ – The Voice of Hendricks County