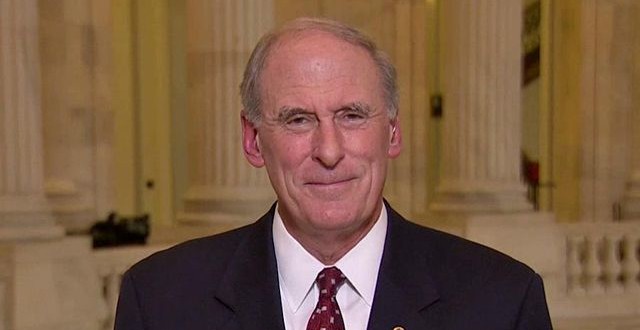

WASHINGTON, D.C. — Joint Economic Committee Chairman Dan Coats (R-Ind.) today delivered the following opening statement during a hearing on tax code complexity:

“It’s fitting that this hearing falls between Tax Filing Day, which was moved to April 18 this year, and Tax Freedom Day on April 24. As Mr. Hodge may explain, Tax Freedom Day represents the day taxpayers can stop working to pay off what they owe the government and start earning for themselves and their families.

“Unfortunately, Tax Freedom Day does not include freedom from complexity. Throughout the year, taxpayers will have to gather and store receipts and records to deal with next year’s filing deadline. Some taxpayers will even make business or even personal life decisions based on some quirk in the tax code.

“I wanted a tangible example at this hearing of just how complex tax law is. That’s why these boxes are stacked in front of the dais. In 2014, a publication that includes the tax code, regulations, and court decisions that determine tax law totaled over 74,000 pages. If my staff had printed this out, they would need the 15 boxes of paper represented here.

“I have good news and bad news to report with respect to 2015. The good news is that the latest version has fewer pages.

“The bad news is this was not due to a decrease in the number of tax laws. It was because the explosion of pages no longer fit in the binders, so the publisher shrank the font size. Now taxpayers really have to pay attention to the fine print because it’s all fine print.

“No wonder 90 percent of taxpayers pay a tax preparer or buy computer software to help them figure out their tax burden.

“Even before the new tax complications of the Affordable Care Act, the Internal Revenue Service estimated that taxpayers spent over 6 billion hours each year preparing and filing taxes. Estimates of the dollar cost to taxpayers range in the hundreds of billions.

“Complexity comes with many costs. Aside from frustration and anxiety, it causes taxpayers to spend time and energy that could be put to much more productive uses, including time with family.

“It costs the Treasury, since taxpayers make innocent mistakes and are never sure exactly what they owe. And it breeds a sense of distrust in the system when taxpayers suspect others are getting a better deal because they figured out how to game the tax code.

“But is there a real economic cost? Would America as a whole be dramatically better off with a much simpler, pro-growth tax code?

“I think I know the answer, but I look forward to hearing the views of our distinguished witnesses.

“Today we will hear from Dr. Art Laffer, known as the father of supply-side economics. We also have Scott Hodge of the Tax Foundation, which is famous for its tax research. We will also hear real-life stories from Joe Grossbauer, a small business owner who lives with tax complexity every day. Our final witness is Jared Bernstein of the Center on Budget and Policy Priorities.

“My thanks to all of you for tackling this complex issue, which I hope will become much simpler.”

Click here to watch the video.

WYRZ.org 98.9 WYRZ – The Voice of Hendricks County

WYRZ.org 98.9 WYRZ – The Voice of Hendricks County