INDIANAPOLIS (Dec.1, 2017) – Customers inadvertently charged a one percent food and beverage tax by identified Whitestown restaurants have the opportunity to apply for a refund, announced Indiana Department of Revenue (DOR) Commissioner Adam Krupp.

“Though it is unfortunate that customers were charged the wrong amount of tax on their purchases, the Department of Revenue is focused on assisting impacted customers recover as much of their money as possible, while working with local businesses to register them within the proper taxing districts,” said Commissioner Krupp.

“Once this issue was brought to our attention, we immediately began collaborating with local businesses and town officials to straighten things out, developing a plan for refund processing and identifying opportunities for overall process improvement.”

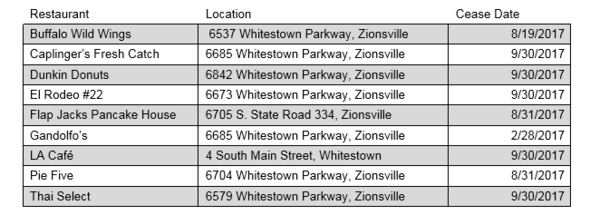

Customers can apply for the one percent food and beverage tax refund for tax paid prior to the date the restaurants ceased charging the tax. The 10 restaurants and the date upon which each ceased charging the tax are listed in the chart below.

Pursuant to Indiana law, refund claims are subject to a three year statute of limitations. As such, customers are only entitled to a refund of a food and beverage tax improperly paid for a period of three years prior to the request of refund.

To receive a refund, customers should submit both of the following items: (1) Claim for Refund form (GA-110L). Customers can access the GA-110L form via the Indiana DOR website at www.in.gov/dor/4036.htm. (2) Proof of Purchase. Customers must provide a copy of receipt(s) or a valid financial statement from an accredited financial institution. Receipts and statements must include the name and address or location number of the restaurant, along with the transaction amount. If customers submit a financial statement, they are encouraged to redact unrelated account information.

Upon approval of a refund request, customers will receive their refund via mailed check. Customers have multiple options to submit the GA-110L form and supporting information: -Mail to the Indiana Department of Revenue, PO Box 935, Indianapolis, IN 46206; -Visit Indiana’s Department of Revenue at Indiana Government Center North or any of the Department of Revenue’s 11 District Office locations; or -Email to RefundClaim@dor.in.gov.

“As we move forward, the introduction of geo-mapping software to pinpoint business location, regardless of the assigned postal zip code, will not only ease the burden on local businesses during the registration process, but it will greatly reduce the risk of this happening in the future,” said Commissioner Krupp.

For more information regarding the refund process, customers are encouraged to call 317-232-2339 (option 2), or visit www.in.gov/dor.