INDIANAPOLIS – Lt. Governor Sue Ellspermann announced today that the state is awarding more than $14.3 million in rental housing tax credits to 18 multi-family housing developments throughout Indiana. Project activities include new construction, rehabilitation, adaptive reuse (conversion of existing structures), and the preservation of historic buildings funded through the Internal Revenue Service Section 42 Rental Housing Tax Credit (RHTC) program.

“Rental Housing Tax Credits are one of the most important tools we have to encourage the production of affordable housing,” said Lt. Governor Ellspermann, who chairs the Indiana Housing and Community Development Authority (IHCDA). “The 18 new projects will contribute greatly to the overall development and stabilization efforts of these communities.”

IHCDA administers and manages the federal credits, which provide incentives for private developers to further the affordable housing choices available throughout Indiana. The 2016 RHTC allocation totaling $14.3 million will fund over 800 housing units.

With fifty applications received in November 2015 requesting just under $42.4 million in federal rental housing tax credits and $16.1 million in supplemental IHCDA funding, the RHTC program is highly competitive.

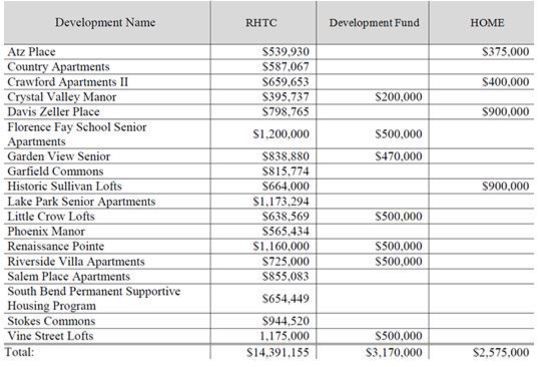

Click here for a full list of applications and awards.